Bridging Investors with Intellectual Property

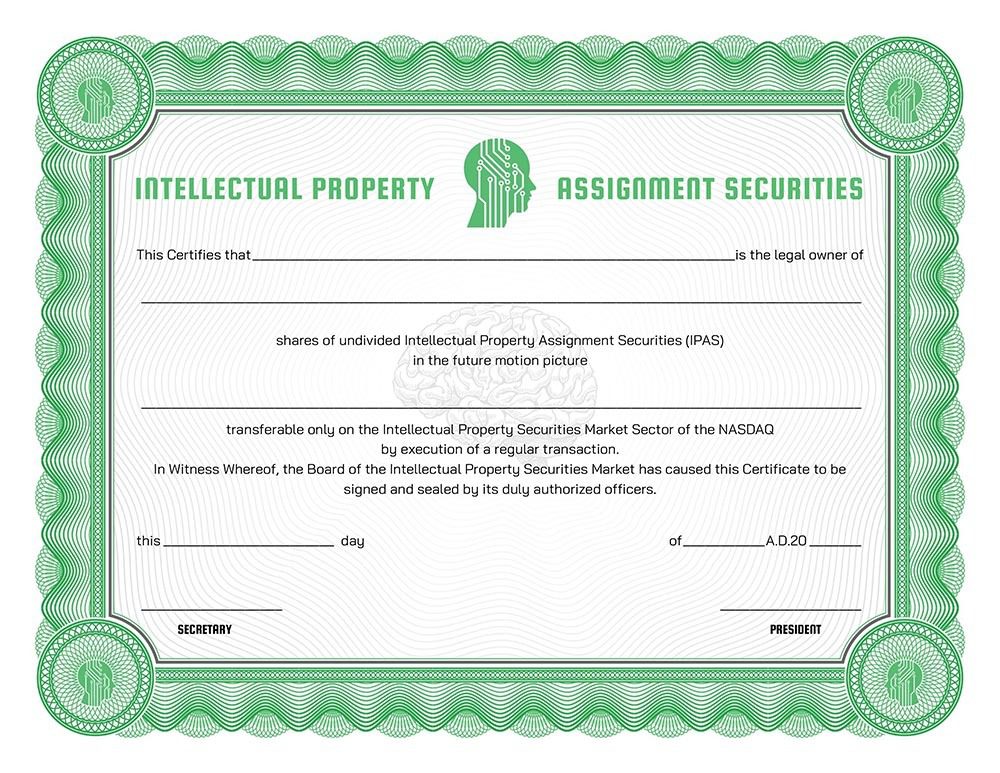

In the dynamic world of finance, the introduction of Intellectual Property Assignment Shares (IPAS) invented by Marc Deschenaux, marks a significant innovation, offering a unique investment opportunity that directly connects investors with the fruits of intellectual creativity. IPAS are a new kind of security that combines elements of royalties assignment and pass-through securities, creating a novel pathway for investment in intellectual property (IP).

Understanding Intellectual Property Royalties Shares

- Royalties Assignment Share:

- At the core of IPAS is the concept of royalties assignment. This component enables investors to receive a portion of the royalties earned from a particular intellectual property. This could include royalties from patents, copyrights, music rights, software licenses, and more.

- The assignment of royalties implies that investors have a direct financial stake in the revenue generated by the IP. Unlike equity ownership in a company, this arrangement focuses solely on the income stream from the IP.

- Pass-Through Securities Mechanism

- The pass-through aspect of IPAS allows the earnings from the IP royalties to be distributed to investors without being first taxed at the corporate level. This mechanism ensures a more direct and efficient transfer of earnings from the IP to the investors.

- This setup mirrors that of Real Estate Investment Trusts (REITs) or Master Limited Partnerships (MLPs), where the income generated passes through to investors, typically providing a steady income stream.

The Role of the IP Issuer

The IP issuer, who owns or controls the intellectual property, is responsible for managing and monetizing the IP effectively. Their ability to enhance the value of the IP and secure profitable licensing agreements is crucial for the success of IPAS investments.

Investor Benefits

Investors in IPAS gain access to a unique asset class, traditionally not readily accessible. This investment offers potential benefits such as:

- Diversification: By investing in IPAS, investors can diversify their portfolios beyond traditional stocks and bonds.

- Income Generation: IPAS can provide a steady stream of income, especially attractive in low-interest-rate environments.

- Exposure to IP Market: Investors gain exposure to the potentially lucrative market of intellectual property.

Risks and Considerations

Investing in IPAS, however, comes with its set of risks:

- Market Volatility: The value of IP can fluctuate widely based on market trends, technological advancements, and legal challenges.

- Dependence on IP Performance: The returns are directly tied to the success and profitability of the underlying IP.

- Complex Valuation: Understanding and valuing IP can be complex, requiring specialized knowledge.

Regulatory Landscape

The creation and trading of IPAS requires navigating a complex web of intellectual property laws, securities regulations, and taxation rules. Ensuring compliance and transparency is vital for the credibility and success of these securities.

Conclusion

Intellectual Property Assignment Shares present an innovative way for investors to tap into the value generated by intellectual property. They offer a blend of income potential and exposure to the creative economy. However, like all investments, they require careful consideration of the associated risks and a thorough understanding of the IP market. As the world increasingly values intellectual creativity, IPAS could play a pivotal role in the future of investment.